Private Equity 20 Lectures(19)A Brief History of Private Equity

Private Equity: 20 Lectures, Legal Essentials for Silicon Valley Investors, I'm U.S. Attorney Xiaoxiao Liu.

When many people talk about the origin of venture capital, they have to mention Columbus' voyage, and there is no denying that Columbus must have given Queen Isabella a great roadshow. But is it fair to say that the Egyptians were also successful in convincing the Pharaohs of the need for such great projects as the pyramids? Where did private equity come from? Where are we today in the evolution of private equity? And where is private equity going in the future? In the next two installments, we will explore the past, present and future of private equity.

1800s: Risky investments in the whaling industry

Harvard professor Tom Nicholas (Tom Nicholas) once wrote a book "VC: An American History", which is translated as "Venture Capital: An American History". Some people don't understand, you said that the United States after World War II is the core area of venture capital, but the United States in front of a few hundred years, what has to do with venture capital.

It was actually because of the whaling industry in the United States. Some people will say you don't want to talk nonsense, whaling is not always in Northern Europe and so on. Then I really have to tell you, in the 20th century, the United States is the whaling industry deserved to be the world's top seller. Before the invention of the electric light, everyone still used oil lamps, and the large-scale exploitation of oil until 1859, before that time, Europeans used whale oil to light lamps.

After the British colonization of the United States, if the plantation is the first bucket of gold in the United States on land, then the contemporaneous 300 years of whaling history is the first bucket of gold in the United States at sea.

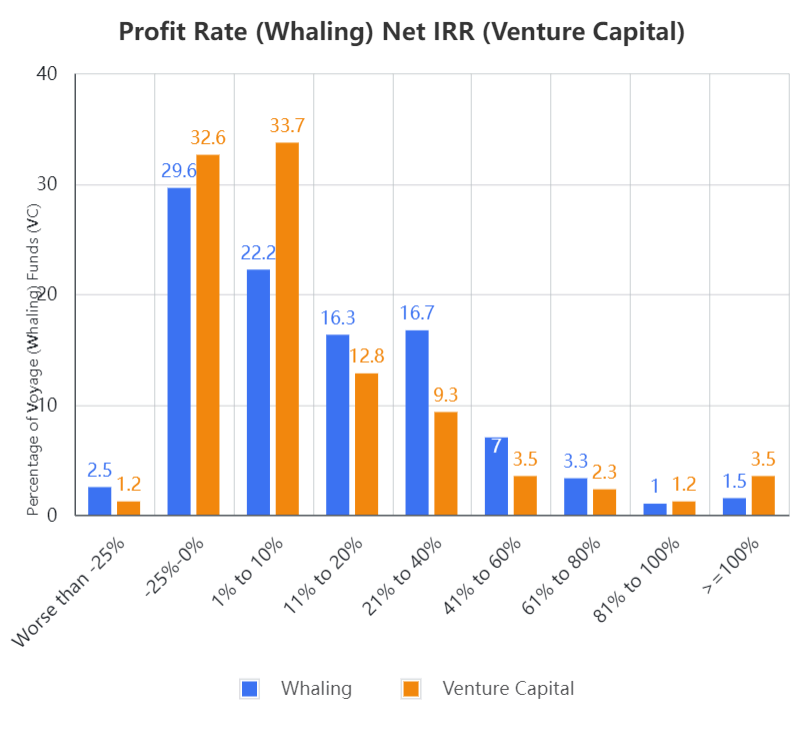

So what do you think this whaling and venture capital have to do with each other? If you compare the returns of the top 29 whaling companies with the returns of the top 29 venture capital funds, you'll see that the curves are strikingly similar and both fit a statistically skewed distribution.

Skewed distribution is a concept corresponding to the normal distribution, both are statistical frequency distribution. Most of our usual statistics are normally distributed, such as height 160cm-180cm these people in the middle of the most people in the majority of the population, the left side of the axis of the 150cm or even 140cm extremes account for a very small number of people, but also on the right side of the axis of the 190cm and 200cm of the people are relatively few, that is to say, this kind of bell-shaped, peaks in the middle of the curve is the most common statistical distribution.

A skewed distribution, on the other hand, is this curve with the peak on one side, either the left or the right. This type of curve is not common in statistics, but it is the most common type of distribution in the venture capital field and in the whaling industry.

Both the great voyages and the pyramids were once-in-a-century serendipitous events. The first large-scale, industrialized, sustained venture-like phenomenon in history was the whaling industry in the United States in the 17th and 19th centuries.

1880s to 1890s: the DC AC debate

You think Edison was the inventor from our grade school textbooks? No, he was actually a tech startup, entrepreneur, and could be considered a Zuckerberg over a hundred years earlier.

You think Tesla is the electric car running on the highway now? No, he was the greatest American inventor of 100 years ago.

History is so shady that what remains is not always the truth.

Edison, who advocated for DC, backed by JP Morgan's venture capital, won this DC-AC battle, even though today we are all using AC as advocated by Tesla.

This DC exchange battle made people realize the power of capital and made entrepreneurs no longer dare not take venture capital.

However the ensuing World War I and II and the Great Depression silenced venture capital for more than half a century.

1946: The Real Beginning of Modern Venture Capital

Immediately after the war, in 1946, venture capital couldn't wait to boom again. The American Research and Development Corporation (ARDC) was founded.

Look at what an all-star league it was:

Massachusetts Investors Trust chairman Merrill Griswold.

Karl Compton, the president of MIT.

Ralph Flanders, the president of the Federal Reserve Bank of Boston.

General Georges F. Doriot, a Harvard Business School professor whose referred to as the father of venture capital.

Private Equity 20 Lectures, Silicon Valley Investors' Legal Essentials, I'm U.S. Attorney Xiaoxiao Liu, we'll see you in the next installment.